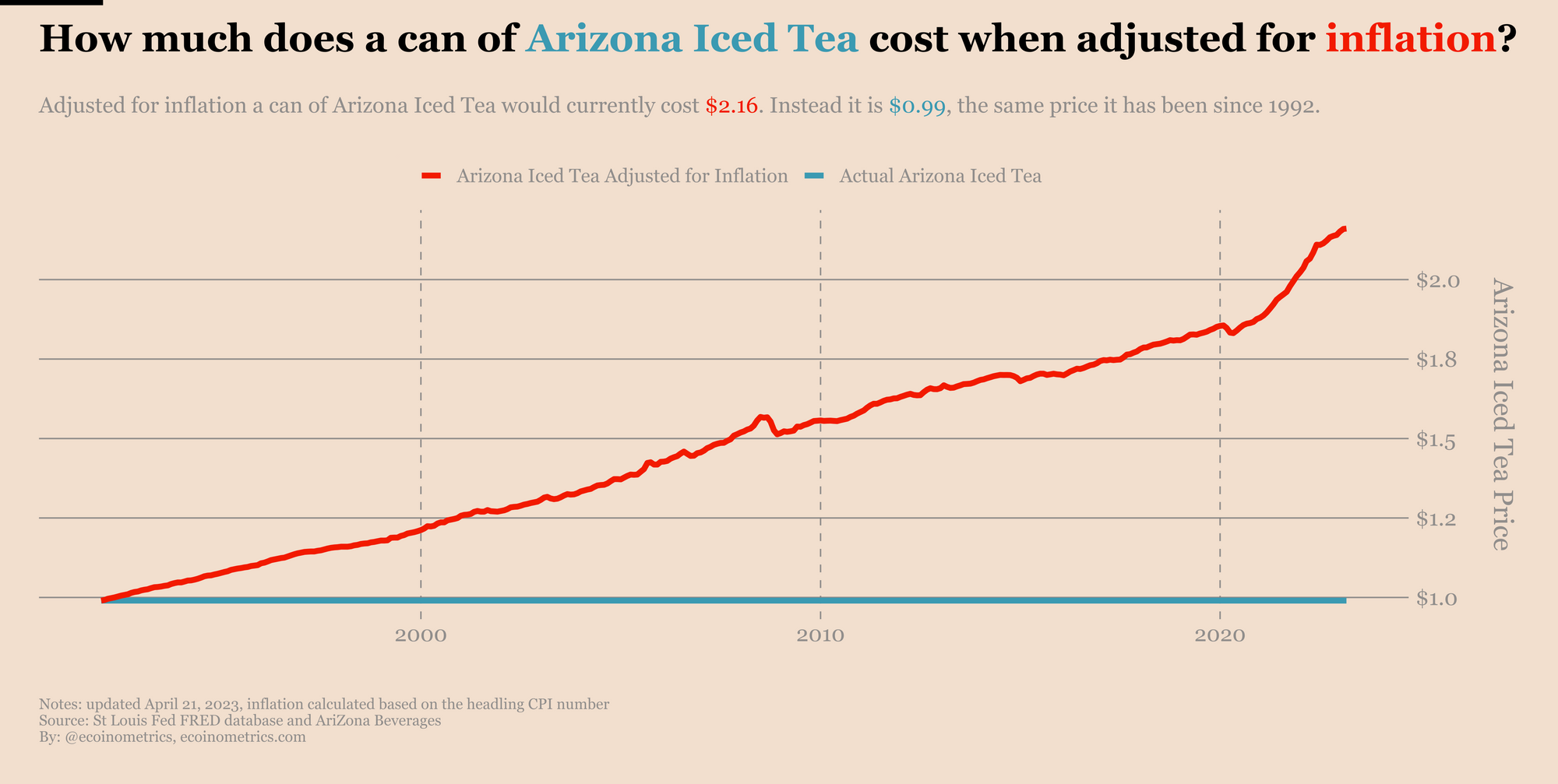

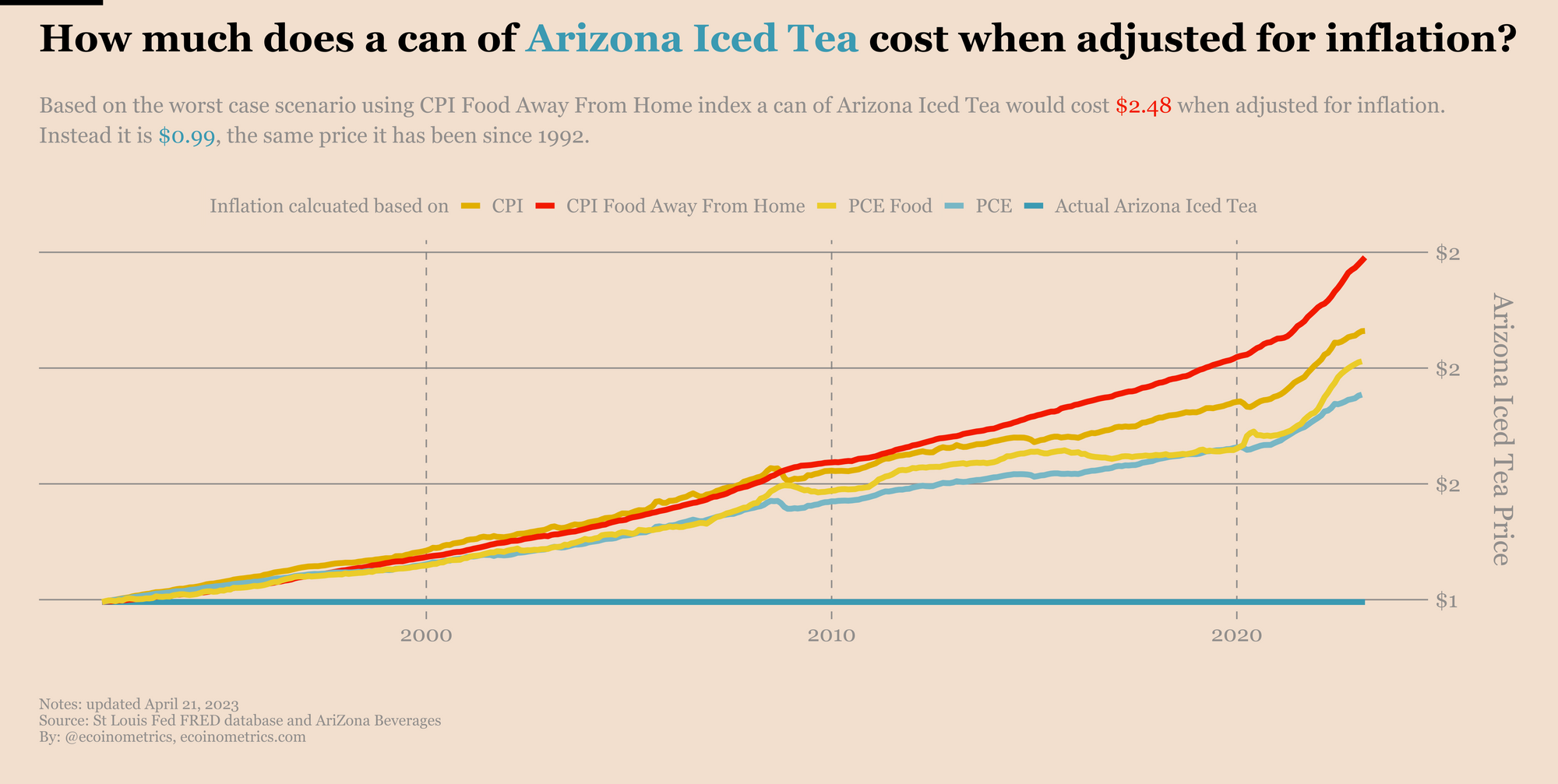

How much does a can of Arizona Iced Tea cost when adjusted for inflation

Adjusted for inflation a can of Arizona iced tea should cost $2.16. Instead it is $0.99, the same price it has been since 1992.

Arizona iced tea isn’t the only company who has chosen to keep prices stable against inflation, Costco has been doing the same with the famous hot dog combo since 1985.

How do you calculate inflation adjusted iced tea prices

Methodology

Here is the inflation recipe:

- Take the price of a can of Arizona iced tea when it was first launched. That was $0.99 back in 1992.

- Take your favourite consumer price index at the time of the launch. That’s your price reference level.

- Apply the growth of this consumer price index (the inflation) to the original price of the Arizona iced tea can. The result is the price adjusted for inflation.

To give an example, if in 1992 the consumer price index was at 100 and it is now at 200 then inflation over that period 2x prices. That means adjusting $0.99 for inflation a can of iced tea would now cost $1.98.

You have only one choice to make for this calculation: which consumer price index you choose to track inflation.

There are many of these that make sense to apply to a can of iced tea:

- The Consumer Price Index (CPI). This is the standard measure of inflation and the one used in our first chart.

- The sub-category of the CPI which contains only the food consumed away from home. That applies more directly to your iced tea can you buy at the convenience store.

- The Personal Consumption Expenditure index (PCE) is another way of measuring inflation which is focusing on what consumers are actually buying (instead of an arbitrary basket of good for the CPI). This is also the preferred measure of inflation by the Federal Reserve.

- The food component of the PCE. Again this one is more specific to iced tea cans.

Let’s apply our recipe to calculate the effect of inflation on the price of an Arizona iced tea can with these four different indices.

Comparing inflations

As of today here is what a can of Arizona iced tea would cost using different measures of inflation:

- $2.48 based on the food away from home component of the CPI.

- $2.16 based on the CPI.

- $2.03 based on the food component of the PCE.

- $1.89 based on the PCE.

That is the cost of a can of iced tea would be up between 91% and 150% since 1992 if AriZona Beverages was passing down the cost to the consumer directly.

Check out the chart.

How does AriZona manage to keep its iced tea price the same despite inflation

As we have seen the cost of a can of Arizona iced tea should have at least $1.89 by now. That would have certainly been the case of Don Vultaggio, the founder of the company, didn’t do everything possible to keep its costs down.

In interviews Don gave some hints at what they have been doing to keep the price under control, it includes:

- Moving a lot of the freight distribution of the cans to trains instead of trucks to save on fuel costs.

- Creating more factories across the US so that cans don’t have to travel very far between the place of production and the place of sale.

- Optimizing the design of the cans so has to reduce the aluminum cost.

- Making smart buying decisions on the basic commodities used in the production of the cans.

All of this adds up to make sure they aren’t losing money while still maintaining the original price which has been an integral part of the brand since 1997.

Now if you are an investor looking to protect yourself against inflation it might be tempting to stockpile loads of Arizona iced tea cans since they preserve their value so well… For sure that’s a better option than stockpiling hot dogs.

But for obvious reasons that’s no very practical. However there are other options to preserve your wealth agaisnt the damages of inflation. For a review of the major asset classes how they fare against inflation go checkout our post with plenty of charts.

If you want to get insights from crypto and macro data to help you make better investment decisions go subscribe to the Ecoinometrics newsletter.

Each issue of the newsletter tells you what you need to know in 5 minutes or less, direct to the point, with lots of charts to allow you to quickly visualize what’s important.

Join more than 19,000 subscribers here: