MicroStrategy Bitcoin Holdings With Charts

Originally MicroStrategy is a business intelligence and software company. But after doing just that since 1989, in 2020 its founder and CEO Michael Saylor decided it was time for MicroStrategy to start focusing on Bitcoin.

By using Bitcoin as a treasury asset for MicroStrategy, Michael Saylor has managed to convert MSTR into a business that is essentially valued as a Bitcoin holding company.

As of today MicroStrategy controls 214k BTC worth about $14bn with MSTR’s market cap being about $24bn.

But let’s dig deeper into the data and Michael Saylor’s strategy for MicroStrategy and Bitcoin.

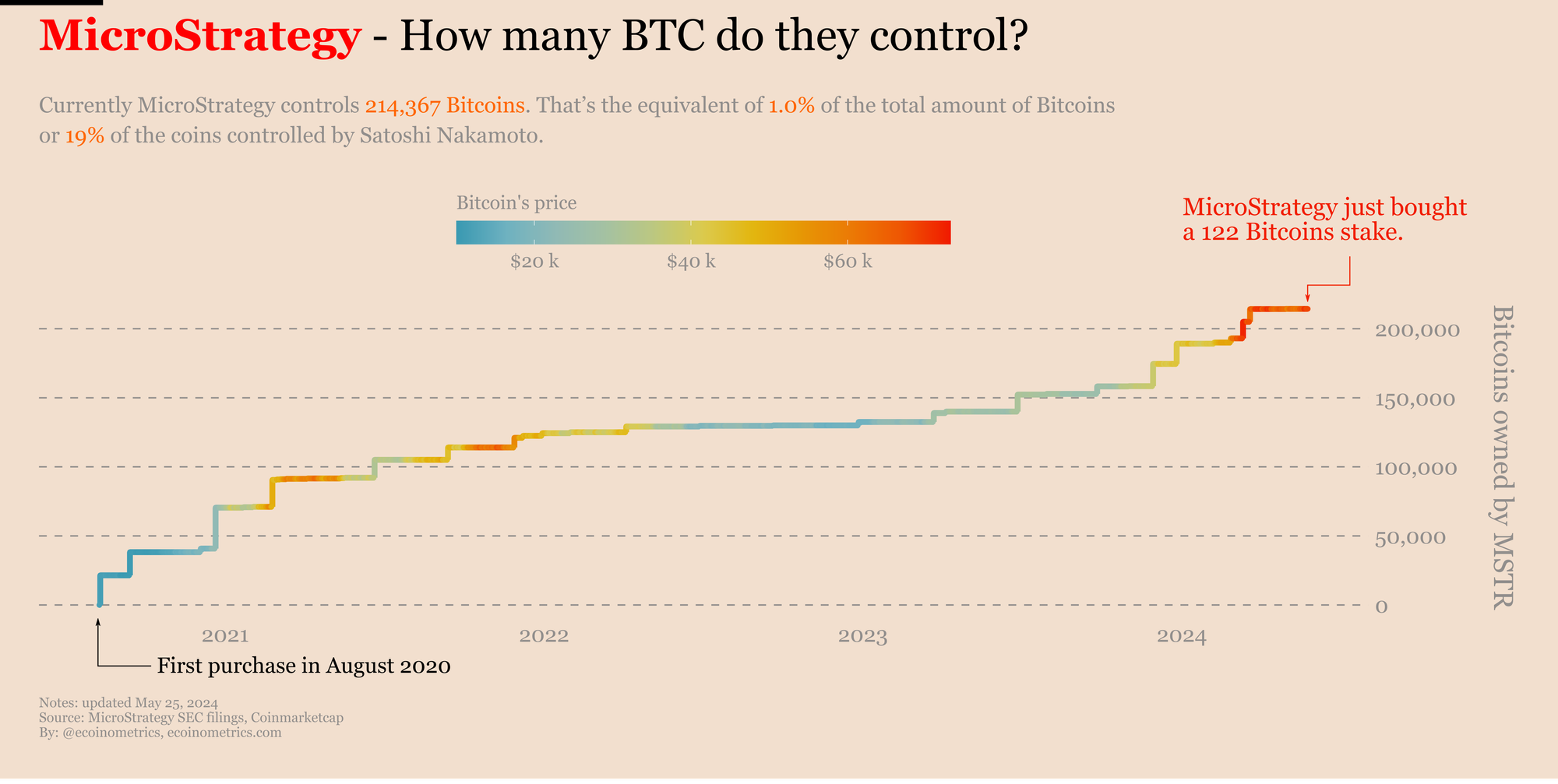

How many Bitcoins does MicroStrategy control?

Currently MicroStrategy controls 214k BTC.

MicroStrategy started putting Bitcoin on its balance sheet in August 2020 (based on MSTR financial reporting). Since then they have continued to accumulate coins with the corporate equivalent of a dollar cost averaging strategy:

- When the software business generates enough free cash flow, some of it is converted to Bitcoins.

- On many occasions MicroStrategy has borrowed money to acquire more Bitcoins.

At this point about half of the Bitcoin they controlled was acquired with their own cash, the rest was bought with the debt they raised.

MicroStrategy bought Bitcoin on 33 different occasions, most of them happening before Bitcoin entered a deep bear market in 2022. But they still continue to buy regularly to this day.

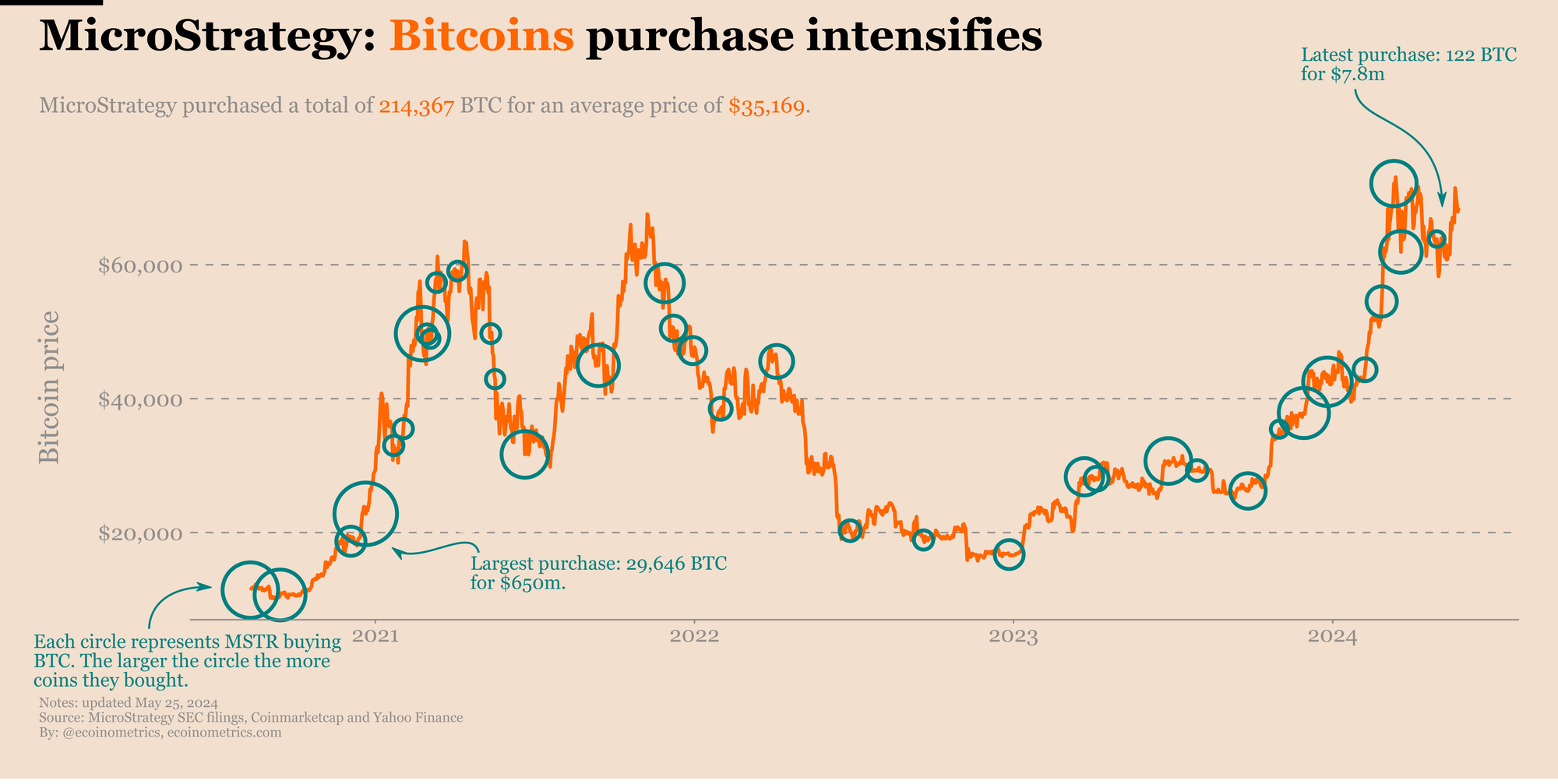

On the chart below you can follow the evolution of the amount of Bitcoins controlled by MicroStrategy. Overlaid with colours is the evolution of Bitcoin’s price over the same period.

As of now MicroStrategy reports controlling:

- A total of 214,367 Bitcoins.

- Equivalent to 1% of the total amount of Bitcoins that will ever be created.

- Also equivalent to 19% of the coins that are controlled by Satoshi Nakamoto, Bitcoin’s pseudonymous creator.

Those numbers are no small boy stuff.

At what price did MicroStrategy buy Bitcoin?

MicroStrategy has bought Bitcoin for an average price of $35,169 per Bitcoin.

The chart below shows you the evolution of Bitcoin’s price since MicroStrategy started buying for the first time. Each circle represents one purchasing event from MicroStrategy. The larger the circle the more coins they managed to purchase in that event.

As you can see, MSTR was buying coins very regularly until Bitcoin’s value severely dipped after the first quarter of 2022. But even in the depths of the bear market MSTR continues to acquire coins.

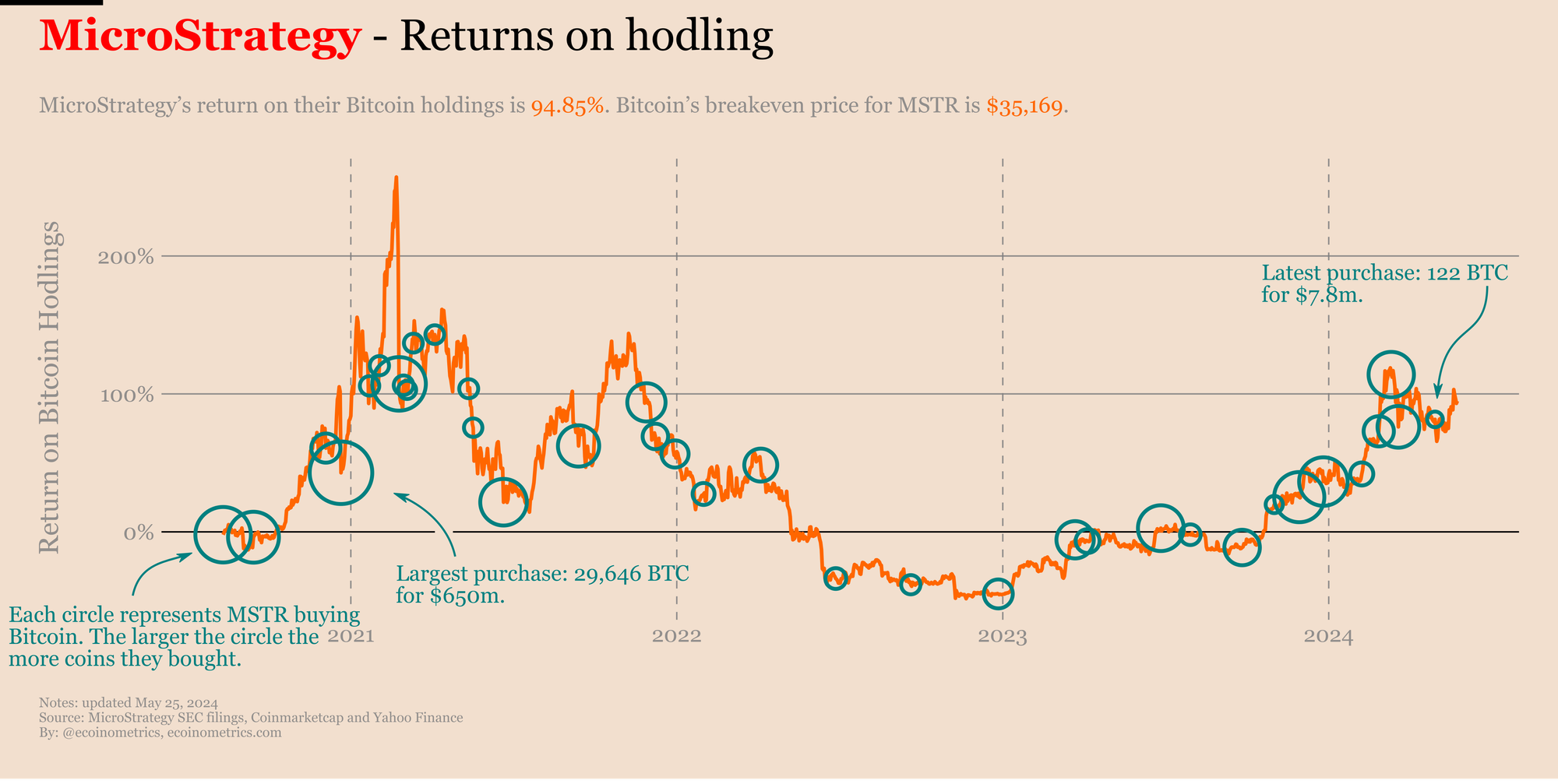

What are MicroStragy’s returns on Bitcoin?

MicroStrategy’s breakeven point on their Bitcoin holdings is $35,169. That means MicroStrategy is up 95% on their Bitcoin holdings.

That's not enough to keep up with inflation over the same period but Michael Saylor's bet is a long term one.

You can see the evolution of those returns on the chart below. Every Bitcoin purchase event is represented on the chart by a green circle. The larger the circle the more Bitcoin MicroStrategy was able to acquire on that event.

At the lowest point of the bear market in 2022 MicroStrategy was down -48% on their Bitcoin holdings.

What is MicroStrategy’s plan for Bitcoin?

Let’s recap what is MicroStrategy’s Bitcoin strategy:

- Convert cash they have into Bitcoin.

- Raise debt when that makes sense to buy more Bitcoins.

- Hold those coins forever.

If the value of the coins they hold relative to the size of MicroStrategy’s software business was small you could argue that it is just MSTR diversifying their balance sheet.

But given the size of this Bitcoin operation we have something completely different.

Michael Saylor has essentially transformed his software business into a Bitcoin holding company. And this is essentially a double leverage on Bitcoin:

- Most of the value of the company is stored into Bitcoin.

- MSTR stock price is basically following Bitcoin’s price movements.

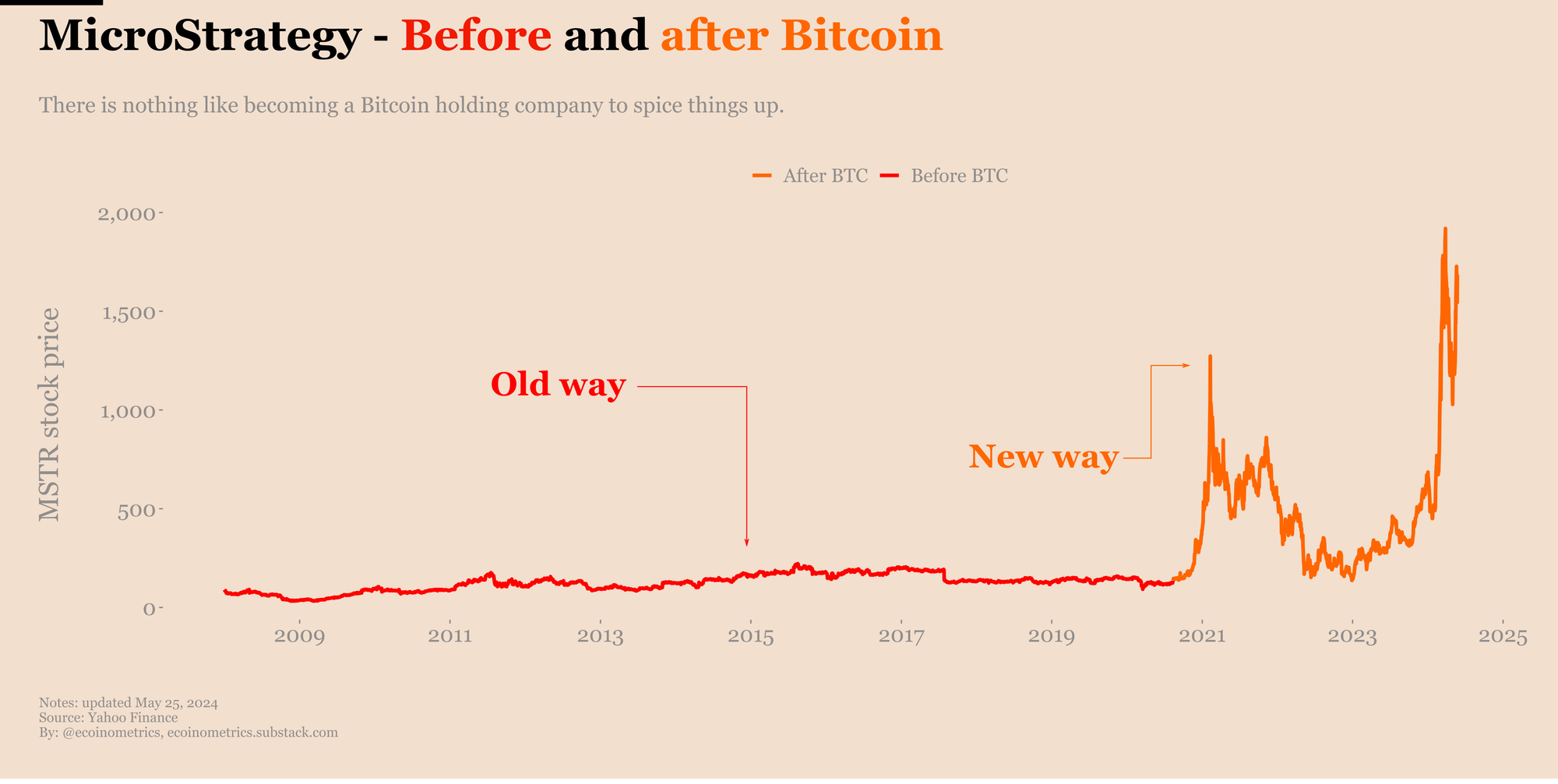

For him that makes sense when you consider that before implementing this Bitcoin treasury strategy MicroStrategy’s stock price was going nowhere. Now MSTR is tethered to Bitcoin for better or for worse. But at least it is doing something.

Just checkout the before and after Bitcoin on the chart below.

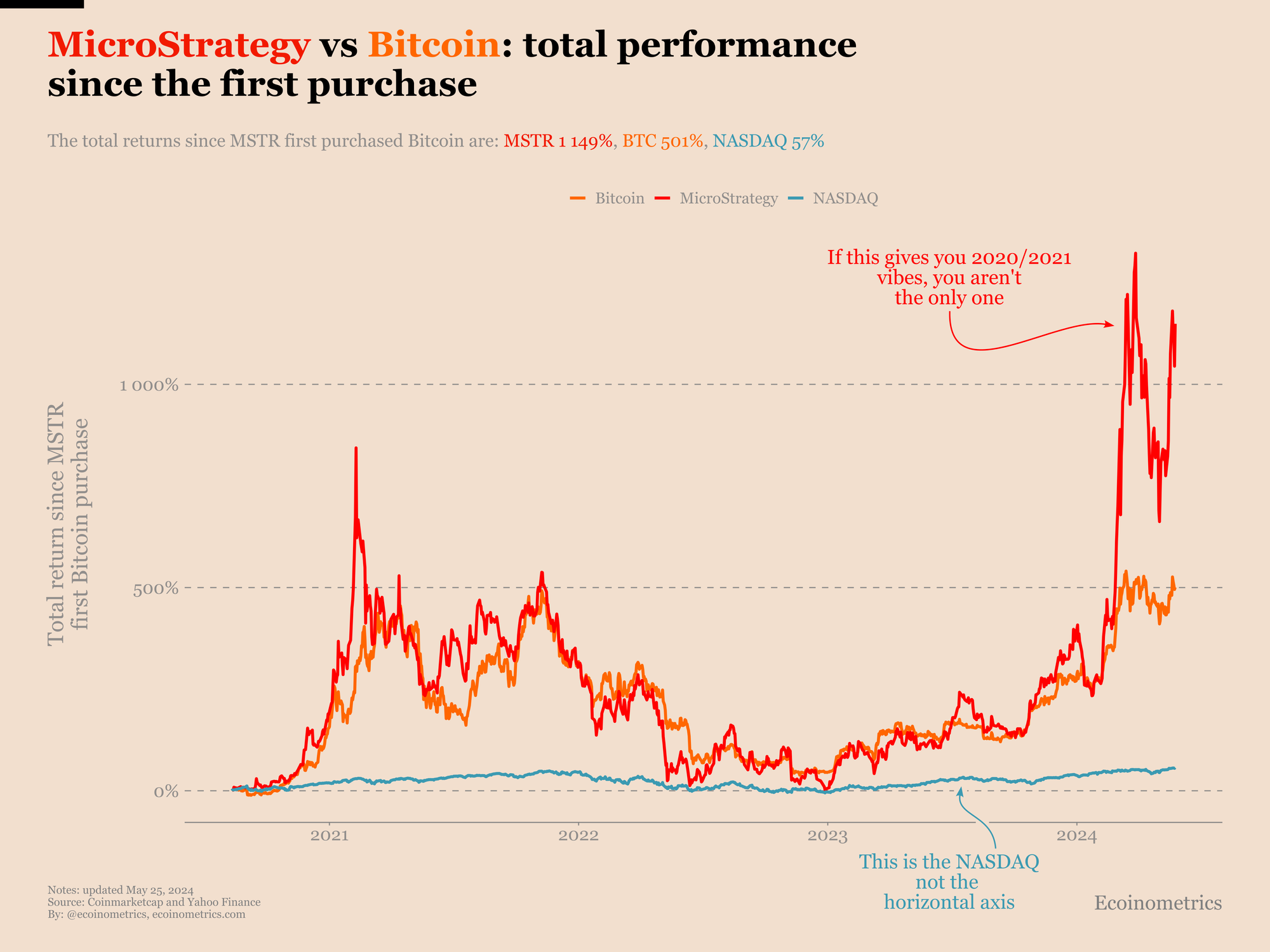

And since MicroStrategy started buying Bitcoin:

- MSTR is up +1 149%.

- Bitcoin is up +501%.

- The NASDAQ is up +57% (MSTR is part of the NASDAQ).

If Bitcoin continues to appreciate in value over the next 5 to 10 years you’ll be able to say that this was a genius move by Michael Saylor.

If anything goes wrong at some point in the near future, like all leveraged bets this could unravel quickly. But the current terms of the debt MicroStrategy has raised to buy more Bitcoin are reasonable enough that the odds seem to be in favour of Michael Saylor.

If you want to get insights from crypto and macro data to help you make better investment decisions go subscribe to the Ecoinometrics newsletter.

Each issue of the newsletter tells you what you need to know in 5 minutes or less, direct to the point, with lots of charts to allow you to quickly visualize what’s important.

Join more than 22,000 investors here: